TAPAS.network | 14 June 2022 | Examining Evidence | Elizabeth Line

TfL finds some positives as it reworks its forecasts for the Elizabeth line

Much has changed in the years since original forecasts were produced in the planning of London’s Crossrail - now just opened as the Elizabeth line. spoke to the TfL team responsible for preparing new figures on expected usuage, and what factors they have looked at as key influences in their latest modelling.

FORECASTING PASSENGER DEMAND for brand new rail schemes is challenging at the best of times, with little to go on in terms of established demand patterns to project forward, or equivalent projects to take as precedents.

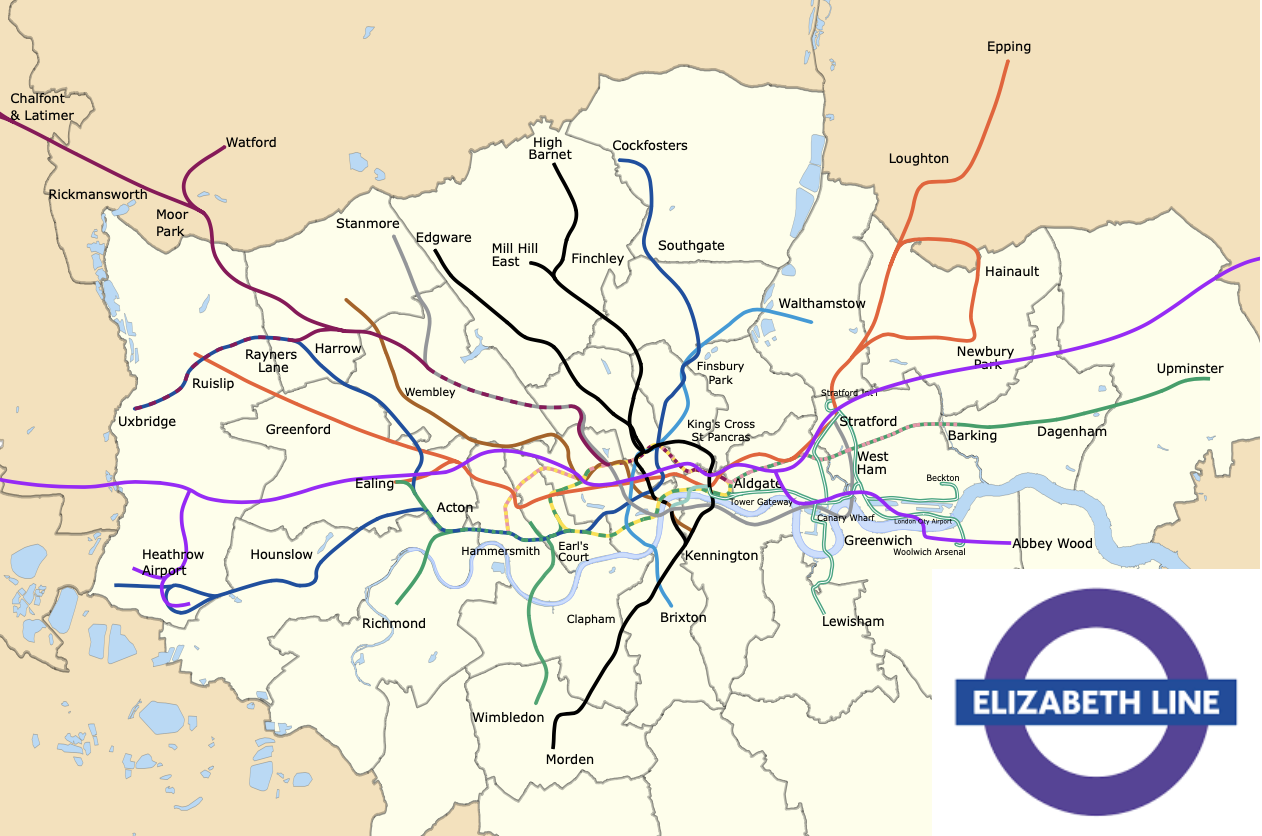

Predicting the public’s response to the Elizabeth line (EL) was in a league of difficulty of its own. Creating a new railway to main line standards (as distinct from London Underground standards) across London from outer suburban termini offering much quicker trips into the city centre, alternative new options to existing users of other lines, plus central area interchange stations at numerous key locations, was unprecedented, at least within the UK.

The long construction period of what was first conceived as the Crossrail project also meant that forecasts for the original business case were bound to be affected by changes. Elements of the phasing and scope also changed during construction. The western extension of services to Reading, for example, was a relatively late addition.

But it was massive traumas to the national economy and life in general that saw the scheme projections buffeted like no other.

The impact of the 2008 financial crash was so severe that in 2010 there were suggestions that the new Conservative government would pull the plug on the Crossrail scheme. However, the government recognised the short-term value of public investment during an economic downturn as well as Crossrail’s longer-term benefits. Between construction and the opening of the central EL tunnels last month, EL passengers forecasts were then undermined by the impacts of the government’s austerity approach to public spending, the UK’s decision to withdraw from the EU, a gradual decline in the number of people commuting five days per week, and then the COVID-19 pandemic followed by a rapid increase in energy prices and the overall cost of living.

It may be surprising, therefore, to learn that TfL principal transport planner David Warner – responsible for producing and maintaining the EL demand projections – believes the original forecast of 200 million EL passenger journeys per year could still be met. TfL’s revised forecasts, compiled last winter, produced a range of 130 to 170 million. However, the lower-end forecasts reflected scenarios where a sequence of successive COVID-19 variants continued to dampen public transport demand. As the line opened last month Warner told LTT that TfL now believes the line is heading towards the 170 million annual journey level.

“There’s more to come on top of that from HS2,” he says. Could that bring the line up to the 200 million? “Very possibly, yes. I think it depends on the recovery rates” he says. “If the recent switch to working from home changes over time, you could very easily see that we start heading up towards the 200.”

He says this comes back to the range of the forecasts. “There’s all these things, both on our network and generally, that could take us there.”

Phase 1 of HS2 includes an interchange station at Old Oak Common that will link HS2 and the EL. Initial HS2 services will terminate at Old Oak Common while the last leg into Euston is completed, likely to result in large numbers of HS2 passengers using the EL. TfL expects many will stick with the EL after the Euston terminal opens. This number will be greater than had Euston opened simultaneously, if regular travellers form the habit of using the EL and do not revert to Euston.

Warner says the forecasts TfL has produced are used by many people for many different purposes, including some which might be surprising. “Historically we think of forecasts as tools to support business cases and the like, and that’s true, but for us this is also now about bringing forecasts into the operational business. The revenue forecasts, for example, are in the business plan that TfL produces, also the station data that we need for operational planning.”

TfL also needs the forecasts to determine future staffing requirements. Businesses in the West End need them to plan investment in their shops, adds Warner. Advertisers on the network – an important element of EL revenue for TfL – need to know how many people will use the new stations and will request granular demographic information.

Warner says the range of the passenger forecasts is narrowing as TfL gains more certainty, from actual usage and from wider post Covid recovery trends. “We use the name ‘hybrid forecasts’ for it, but it’s basically a Covid - consequential forecast over the next 10 years or so.”

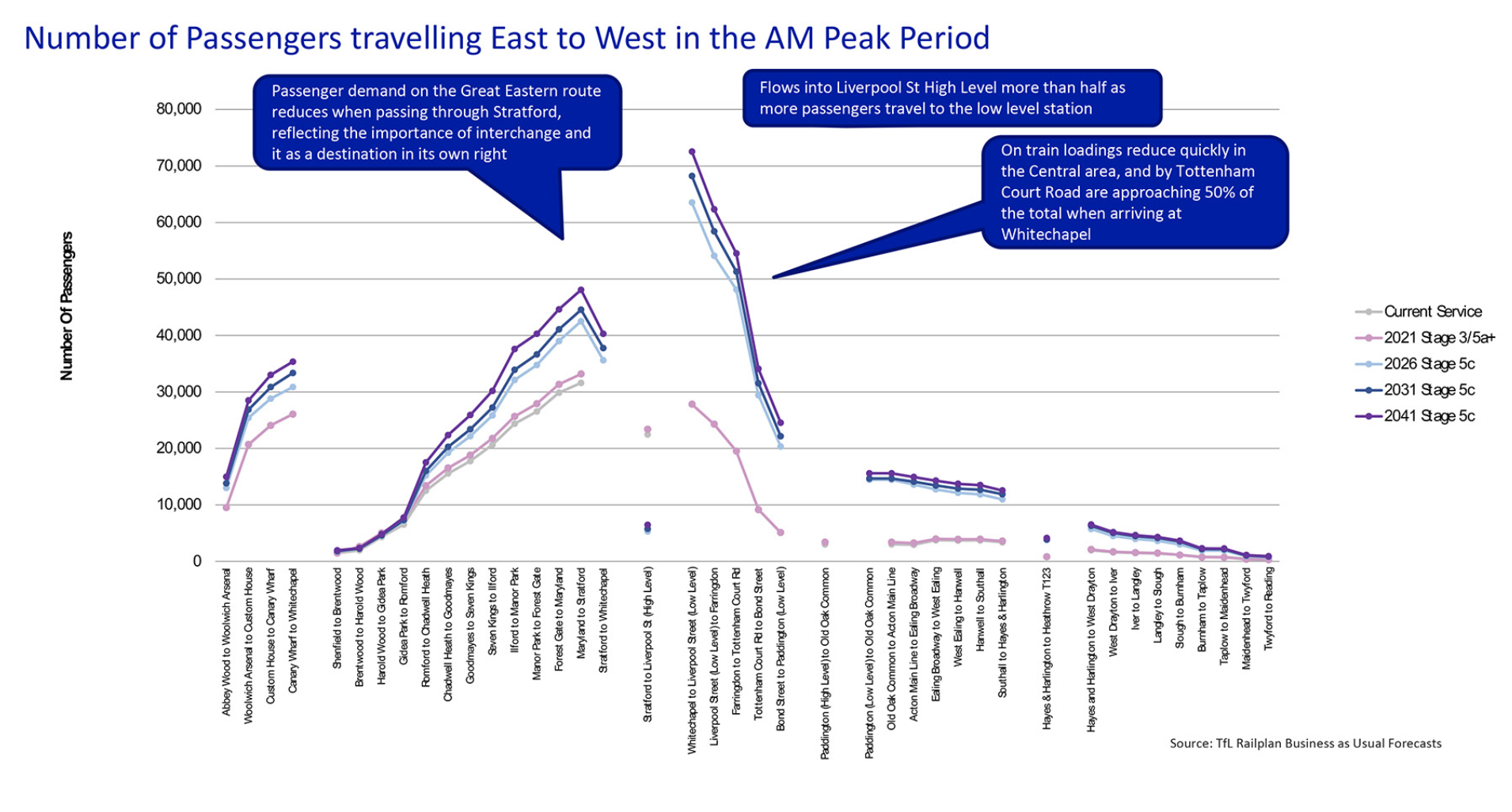

The more pessimistic forecasts are that there will still only be one passenger less per metre of standing space on the trains at Stratford in the peaks, compared with pre-pandemic forecasts. “So, they are going to be busy trains, there’s no doubt about that,” says Warner. “Particularly on the eastern side, there will still be standing passengers. The same into the central section as well.”

He says COVID-19 has changed people’s idea of what is an acceptable amount of personal space on public transport. TfL is trying to understand this. “The research that underpins the models we use is still all based on pre-pandemic assumptions – how passengers place a penalty on crowding and otherwise. “Even now we haven’t really got the research that we can rely on. Behaviour of passengers is changing over time. Older people, for example, may be more concerned about busy trains and crowding in a post-Covid world. We need to get to a more steady state where we can do more research to build in. It comes back to our range. We have to produce one number to put in our business plan, but the things we use beneath that are based on a range, for exactly these reasons.”

The DfT have build-up rates that are conventionally used over a four-year period, but on every project that I’ve seen, it happens far quicker than that.

David Warner, TfL principal transport modeller

In the past Warner was responsible for forecasts for the development of the London Overground from former suburban national rail lines, on which volume was much smaller than the EL. He says: “We know that the actuals there were within 10% of the forecasts and had a good comparison with distribution as well as absolute numbers. So, the models do have a pretty good track record. The problem is, when you’ve got 170 million passengers, if you’re 10% out that’s quite a lot!”

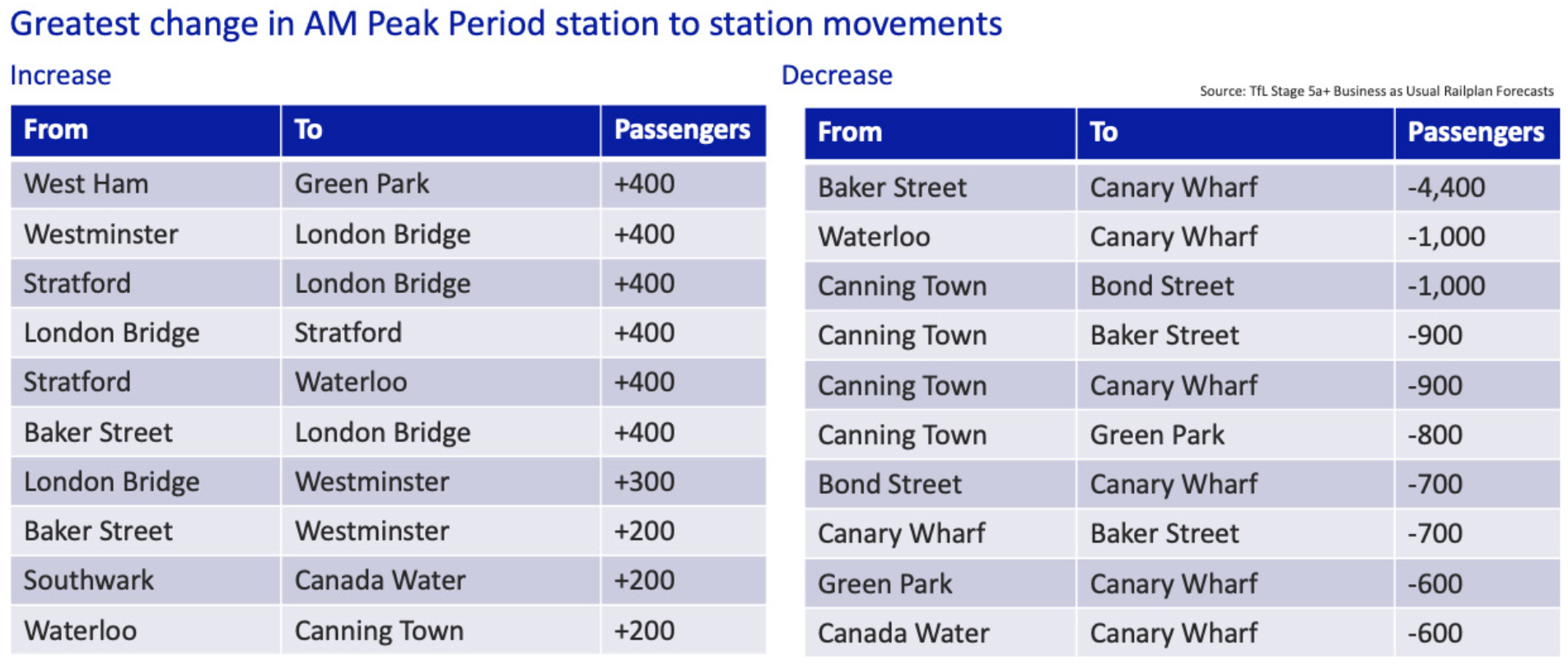

Inevitably, COVID-19 has had a major impact on the EL forecasts. “Travel to Canary Wharf in the Docklands business district is important for the Elizabeth line, but the volumes of people in the financial industry going there are not what they were, due to home working. That will continue,” says Warner. “More widely, there’s maybe more demand in the outer London areas and less in the centre,” referring to the difference between the new and previous forecasts.

Phased opening

The latest forecasts take into account the phased launch of EL services in the central section, starting with the services now running between Paddington and Abbey Wood in South East London on Mondays to Saturdays only. Sunday services will be added later once the outstanding works are completed.

The outer termini of the line at Reading to the West and Shenfield to the East are due to gain their services through the central tunnels this autumn. A phased opening was always intended, but with one additional opening phase and other differences.

One expected change in the autumn could be a reduction in passengers from the Great Western main line who have begun interchanging at Paddington, since the EL will then offer direct services from stations along that line. Conversely, the convenience of through travel from the West to the West End, City and Docklands is likely to stimulate new demand, as well as a shift from other rail services and other modes.

Mode shift is expected to account for only 5% to 10% of EL demand. Warner says it’s a small proportion because there aren’t many car journeys to replace in the centre of London. The mode shift will be most significant at the eastern and western ends, including the Heathrow branch.

Phasing will delay the full impact of the EL on some passenger flows. Nevertheless, Warner thinks that most of the EL demand will materialise quickly. “The DfT have build-up rates within Webtag that are conventionally used over a four-year period, but on every project that I’ve seen, it happens far quicker than that.” London Overground reached 50% of its forecasts in year one and everything in year two, he recalls.

“I can’t imagine many people who live in Abbey Wood, for example, would endure a 30-minute longer journey to work on a non- air-conditioned suburban train now that the EL 5-minute frequency faster alternative is there. We expect the regular passengers to transfer over quite quickly.” He says TfL expects the EL to have reached its four-year forecasts within two years, when the phased opening should be well out of the way and the service should be settled and reliable.

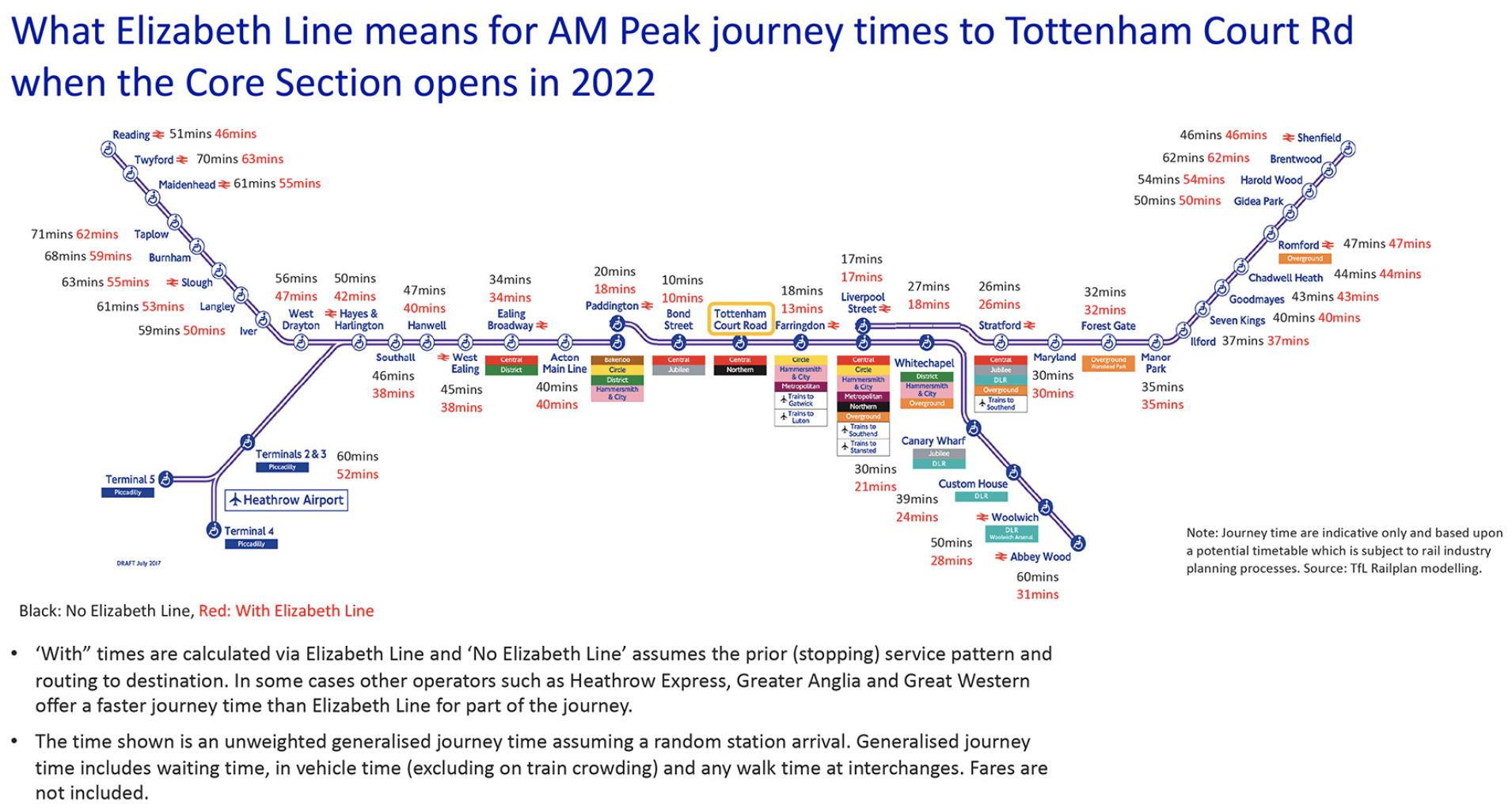

The fortunes of National Rail operators will influence EL demand, not least where the new line provides connections at and between London termini. Warner says this effect is already being seen. Paddington to Liverpool Street by Underground in 30 minutes would have been considered a good journey previously. “Now it’s 10 minutes on EL. It’s really had the effect of shrinking the way London feels.

“It’s also the connectivity. You won’t have to get out at Paddington. It solves some of the crowding issues within the station that we and National Rail may have. The same at Liverpool Street and Stratford.”

TfL’s forecasts have assumed that rail fares will rise by RPI + 1%, but now inflation is approaching 10 per cent. “We’re not looking at a small fare rise potentially coming this way, if we follow what prices are doing,” says Warner. “That will definitely have a dampening effect. The price rises [for goods in general] are a relatively recent phenomenon and keeping up with them when forecasting is a challenge. That effect is forecast centrally and across the TfL business consistently.”

Farringdon station in the City now provides an important interchange between the EL and the many places served by the North- South Thameslink services. Warner says that this and the interchange at Liverpool Street have transformed journey times from north of London to Docklands. This is an example of how the new line is likely to stimulate new demand on National Rail. Trains into Paddington from Bristol and other places in the west have also become more appealing with the EL offering such rapid onward connections into and across London compared with hitherto.

However, Warner cautions that the Thameslink Programme itself has delivered lower benefits than TfL had expected, with 15% fewer Thameslink services now operating through Blackfriars than before the pandemic at peak times. “On National Rail generally, you can see some TOCs with 20% less capacity or frequency than there was before [the pandemic].” This reduction has been built in to the new EL forecasts, but it represents a further uncertainty.

Interaction with the underground is critical

At its heart Crossrail was conceived as, in essence, a relief to the Central line. Passengers are also expected to shift from various London Underground lines for their entire journey, or to change between Underground and EL trains at places such as Stratford instead of using the former throughout. That will reduce revenue attributable to the Underground, but TfL also forecasts increases in passengers using the Underground to access the EL.

For example, when the EL is fully open, morning peak passenger journeys between Paddington and Oxford Circus on the Bakerloo line are expected to decrease by 4,200. Balancing, but generally smaller, increases are expected elsewhere on the Bakerloo, such as 700 more passengers between Queens Park and Paddington, heading for the EL.

A similar impact is expected on buses in certain areas of London, with more demand on routes feeding into the EL at Woolwich Arsenal and Custom House, for example, and less on some routes around Paddington, North Greenwich and Oxford Street.

Warner says that currently after around four weeks operation about 70% of EL passengers had transferred from other TfL services. At Ealing Broadway, a drop in passengers of about 50% is expected. “You frequently hear the argument that the Underground will just fill up again, but at Ealing Broadway it would only fill up again if you built some significant housing developments on top of the station. It is a permanent change that we’re expecting to see there.”

He predicts that the new line will also change the nature of the Docklands Light Railway, which traditionally had a large flow of people to Bank. “DLR becomes more of a feeder network, with more local journeys and people feeding in [to the Elizabeth line] at places like Custom House.”

The state of International Aviation also has a bearing on the EL forecasts. It is still finding its feet post-Covid, as evidenced by the many flight cancellations in the May half-term holiday. “The Elizabeth line serves Heathrow and runs close to City airport [East London],” Warner observes. “What airlines are seeing happening in other countries and the general recovery rate have a bigger impact on the EL than on, say, Underground demand generally,” says Warner.

Luton, Stansted and Gatwick airports are all also accessible with one change of train from the EL.

Heathrow will be an important EL traffic generator. Warner says that rail competes with taxis between London and the airport. For a family of four going on holiday, the premium- priced Heathrow Express is not really a viable option compared with a taxi fare of perhaps £40, he says. “The Piccadilly line is attractive, and the EL now a bit more so.”

Heathrow workers are another important segment of EL demand. Some East London residents who already work at Heathrow may switch to the EL. Others may find that the line opens up job opportunities at the airport. Riding on the EL in the first week, Warner was struck by the number of suitcases on board and the number of cabin crew in uniform. Historically the area around Paddington is where many air crew tended to lodge, but the EL could spread that economic benefit further east.

For work travel more generally, Warner says the EL will be busier in East London than out to the west, where more residents have the option of working from home.

For work travel more generally, Warner says the EL will be busier in East London than out to the west, where more residents have the option of working from home. “In the east of London, you’ve got the engine of London where the workers, the cleaners and such like, live.”

Evaluation study

TfL is embarking on a large impact study of the Elizabeth line, post-opening. “It will look at what has actually happened, what the drivers were and the changes in behaviour – a really detailed bit of analysis,” explains Warner. “A key component of that will be a comparison with the forecasts and how accurate they were, in terms of actual numbers and distribution, and time of day and those sorts of questions.”

The new Paddington station serving the Elizabeth line much increases capacity at this major London interchange

The evaluation involves two strands of work. The more urgent task is to create an early picture of how the railway is performing against expectations, focusing on early actions that can help to capture the scheme’s benefits in full and on time. TfL says it is responsible for realising the line’s direct transport benefits and will work with stakeholders to optimise the wider benefits.

The other strand will analyse impacts which take longer to emerge, such as mode shift and economic growth. This will examine the return on investment, using actual observations of benefits. The first post-opening evaluation study will be produced after 24 months, focusing on the transport network effects. A further study, five years after opening, will focus on those effects and the wider economic, environmental and social impacts.

TfL will draw on a variety of data sources, covering subjects including trips, crowding, customer satisfaction, passenger journey lengths, trips between selected origin-destination pairs, station usage and interchange (particularly Thameslink connections at Farringdon), car parking in new developments and businesses (from the London Development Database), abstraction from other railways and modes, usage of car and cycle parking spaces at EL stations, generalised journey time, journey purpose, crime, and disabled passengers’ use of the EL and their satisfaction.

“This is the biggest test for our models that we’ve ever had,” Warner explains. “The Victoria line was maybe the first to use cost-benefit analysis. That was in the late 1960s. The Jubilee line extension added about 80 million passengers [per annum] when that opened in 2000 and that was the most recent large scheme. The EL is way bigger than that.”

How useful will the Elizabeth line’s post-opening evaluation be to promoters of future rail projects? Warner thinks the Crossrail 2 scheme, now mothballed, will be revisited at points in the future and provides an opportunity for the lessons to be passed on. He also points to smaller schemes, such as orbital rail in North-west London and extending the DLR to Thamesmead. “It’s increasing our understanding should other projects come along. We now have a good chance to validate the forecasts with a big scheme, as opposed to a small one.

“We collected a lot of data before we opened. You need something to compare against as your baseline. Covid has thrown a spanner in the works. We need to be careful when we do these studies that we don’t answer the question: ‘What was the impact of Covid?’ and that we actually drill in and get to the bottom of what’s happened with the Elizabeth line.”

We would like to thank Transport for London for facilitating the conversation upon which this article is based and allowing reproduction of the tables from its Elizabeth Line revised forecast presentation.

David Warner has over 15 years experience of working within the UK transport industry in both the public and private sectors. He is an experienced passenger demand and revenue forecaster with detailed knowledge of economic and financial appraisal and rail strategy development. He undertakes operational assessments using simulation software to understand the impact of service changes and external factors upon the operation of a network. He has been at Transport for London as Senior Business Analyst since 2008.

Rhodri Clark is a specialist transport writer based in North Wales. He has been contributing to Local Transport Today magazine since the 1990s, primarily on Welsh subjects. He appears on Welsh radio and TV to comment on transport issues.

You are currently viewing this page as TAPAS Taster user.

To read and make comments on this article you need to register for free as TAPAS Select user and log in.

Log in