TAPAS.network | 2 October 2024 | Commentary | Richard Sallnow

Timing is crucial for a launch of road pricing - and might that time be now?

There have been a swathe of reports and articles over recent years campaigning and justifying the need for national road pricing in the UK, but it is critical to get the timing right. It could potentially take around three and a half years to put in place, believes . With a new Government in office, might the time to begin that process be now, he wonders? In this third part of his look at the topic he stresses it would require public and private sector collaboration, extensive public engagement and a good dose of political will.

IN MY PREVIOUS two articles (TAPAS 5 June 2024 and TAPAS 2 July 2024), I set out what a prospective UK national road pricing scheme could look like, and who would be responsible for designing, implementing and managing it.

This included a suggested introductory scheme to tackle the Treasury’s forecast £28bn budget hole owing to depleting fuel duty because of the shift to zero emission vehicles (ZEVs). But if there was a decision to go ahead, how soon could the wheels get turning, and how long would it be for a scheme to be actually be in place?

Setting out the likely specification of the first UK road pricing scheme, and the organisational responsibility for the design, implementation and operation of it will take time. It requires public and private sector collaboration and extensive public engagement. But, with political will and urgency, how quickly could a scheme realistically be ‘stood-up’, and when is the optimum time to launch?

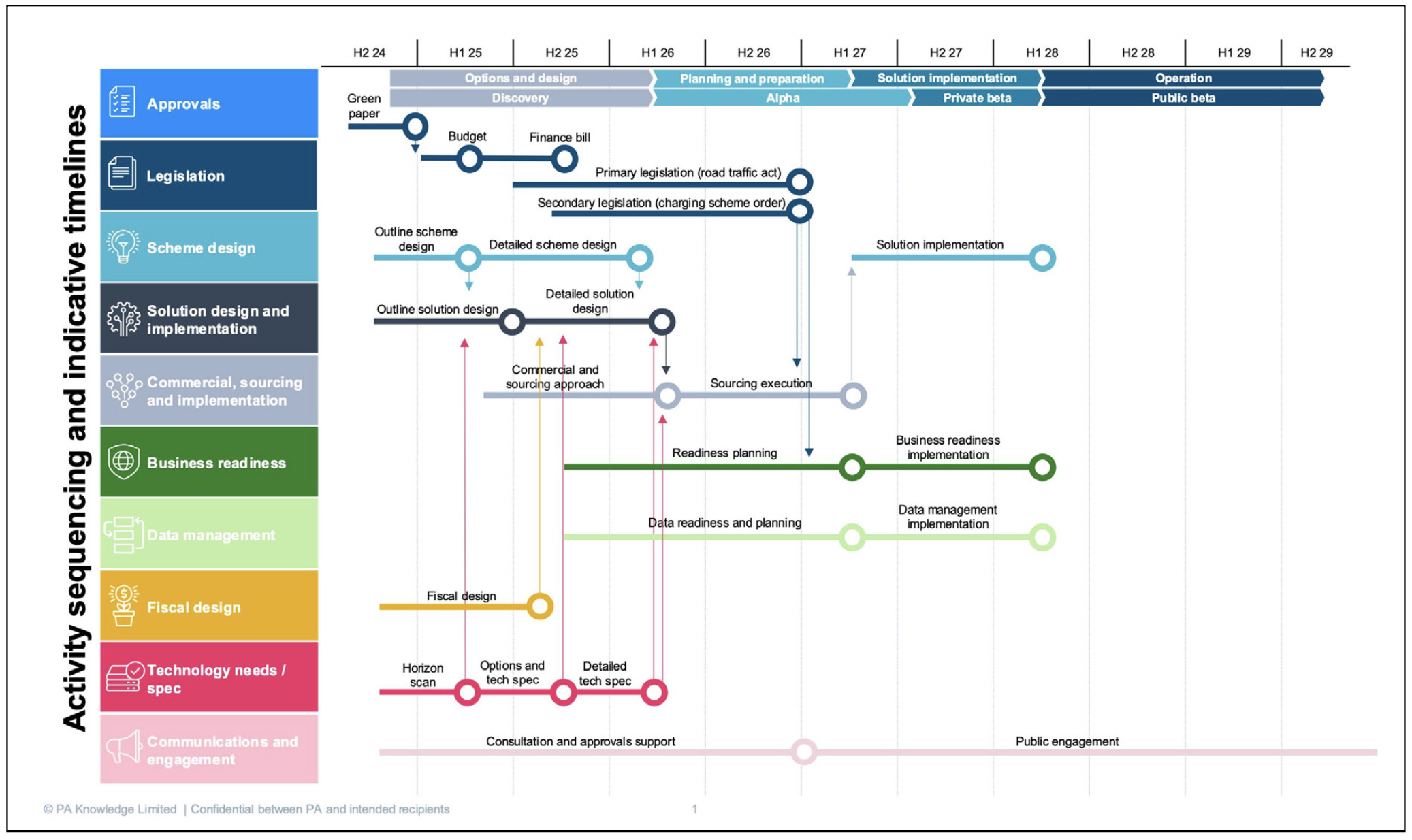

To fully understand this process, first we need to consider what would be required from a service, legislative, technical, people, process and data lens to work out indicative timelines.

As explored in the first two of my earlier articles, the headline activities needed here include:

Legislation: Detailed legislative authority will be needed to enable the introduction of road pricing. The use of a Finance Bill could accelerate this, however other elements of legislative and regulatory change will need to be considered too, such as amendments to the Road Traffic Act, Vehicle Excise & Registration Act, Data Protection Act, and Transport Acts.

Payment Scheme design: The design of a scheme will need to be specified with clear areas relating to payments such as: what is the per mile charge by vehicle class? What (if any) discounts or exemptions should apply? What ‘account’ services should be offered? What frequency should payments be made?

Fiscal design: Any scheme will need to be based on designing financial flows that clarify who is responsible for the collection, management, and allocation of taxes received, as well as budget management across each organisation that forms part of the solution.

Solution design: A blueprint for the design of the proposed solution will need to provide clarity on how the technology, operational management, data flows, processes and service is structured and will integrate.

Technology specifications: Defining technology needs and specifications to deliver the solution will be essential. This would range from the use and/or upgrade of existing systems, to the establishment of new ones.

Data management: Developing a robust plan to capture, validate, store and protect data and data flows across and between organisations and systems will be an integral part of any scheme.

Commercial sourcing and implementation: A road pricing scheme will require design of an optimum approach to put in place capabilities to deliver the solution, including how the capabilities are packaged or grouped, whether developed ‘in-house’, or procured from the market.

Business readiness: Any road pricing proposal will need to reflect the business change required to operate the new solution, which includes assessments of organisational readiness to deliver, for example how might the Driver and Vehicle Standards Agency (DVSA) or the Driver and Vehicle Licensing Agency (DVLA) need to adapt if either were to play a role?

Communications and engagement: An integral part of a scheme will be the design of communication and engagement activities that enable the least resistance and greatest awareness, for example, simple and clear messaging to the public of what will change and when. This will form an integral part of the scheme’s success in enabling compliance and avoiding unwanted penalties.

Based on prior experience in other similar projects, an indicative timeline (best case) for each area has been captured in the accompanying critical path chart presented below, sequenced to enable the fastest end-to-end delivery timeline. This presents an indicative timeline of three and a half years to implement UK road pricing, subject to political will to put the scheme in place at pace – critically, within a single political governmental term.

Protecting fuel duty revenues

Whilst three and a half years might be the quickest that a scheme could be introduced, the economic and political context also needs consideration –e.g how long can government sustain the fall in budget taking place under the existing road user taxation system?

The projected reduction of the annual fuel duty income shows by 2034 the budget will have reduced by half to below £14bn a year - the amount that covers expenditure on the road network today. If other sources of revenue have been put in place, it could suggest a less-pressing urgency to introduce a national road pricing scheme.

A critical path timeline to implement road pricing

However, if Government wants to maintain the established annual revenue inflow of £28bn from fuel duty, the question becomes that of recognising the tipping point for action on an alternative. If greater than a 20% decrease (£5-6bn) is deemed unacceptable, 2027 would be the year a road pricing scheme would need to be in place.

Getting road users onboard

The introduction of a new road pricing scheme seems likely to be highly unpopular - evidenced in 2007 when a petition of 1.7 million signatures impacted Government’s interest to introduce road pricing at that time. Whilst there are very few, if any, measures that will make a scheme actually welcomed by the public, there are options available to ease the introduction. These include:

-

Introduction of an annual allocation of ‘no cost’ miles per vehicle eg ‘your first 5,000 miles is free’. This could both ease the message to the public and promote a reduced level of car use at a time when congestion is expected to increase.

-

However, if this is the approach, to still collect the existing £28bn will bring the impact of a substantially higher per mile cost for each mile over 5,000 miles, meaning an anticipated doubling of the per mile fee after the first 5,000 miles.

-

Introduction of a per mileage-based scheme for new ZEVs purchased after a certain year. This would allow the public to consider this in their own financial planning when purchasing a new vehicle, and allow a softer introduction without penalising those that own ZEVs today.

-

Introduction of a per mileage-based scheme just for vehicles over a certain price threshold (for example £50,000) Applying the charge in this way would however brings complexity to the scheme and result in ‘edge case’ equity challenges.

-

Introduction of a per mileage-based scheme for larger vehicles first. This could again be felt to be detrimental to the scheme’s equity, with a specific demographic being penalised more than others.

The implications of this non-exhaustive set of alternative approaches would need to be understood fully before any specific approach were decided upon. However, an approach that provides the public with advance notice of an introductory road pricing scheme (point two above) and considers an amount of ‘free’ miles (point one above) to promote reduced mileage, might be welcomed and ease the pathway to introduction of the new system.

The sequence of events and the decision making needed is undeniably complex. But there are many other countries considering or who have already implemented a successful national scheme, such as Iceland and New Zealand, on whose experience to draw.

Should the UK’s HM Treasury have concerns about seeing greater than a 20% reduction in annual fuel duty income take place, a scheme would need to be implemented and operational by 2027. Introducing a scheme before 2028 would be challenging, so the time is therefore arguably now to be considering a national road pricing project. Or, if not, we should expect the impending arrival of substantial alternative tax increases in other areas of Government.

-

The first part of this article can be viewed here: Road pricing is coming – but what form will it take?

-

The second part of this article can be viewed here: Who should design and deliver a national road pricing scheme?

Richard Sallnow is a Partner at PA Consulting

This article was first published in LTT magazine, LTT900, 2 October 2024.

You are currently viewing this page as TAPAS Taster user.

To read and make comments on this article you need to register for free as TAPAS Select user and log in.

Log in